IBM Stock: Latest News, Analysis & Investment Insights

Is IBM, the venerable giant of the tech world, still a worthwhile investment in this rapidly evolving landscape? Despite recent fluctuations and a complex transformation journey, the consensus among analysts leans towards a 'buy' rating, suggesting that the future of IBM may be brighter than some perceive.

The International Business Machines Corporation (IBM), a name synonymous with innovation and technological advancement, has been a cornerstone of the global economy for over a century. From its humble beginnings as a tabulating machine company to its current status as a multinational technology powerhouse, IBM's journey has been marked by constant adaptation and reinvention. Today, IBM's focus centers on hybrid cloud and artificial intelligence (AI), a strategic pivot designed to secure its place in the future of technology.

To understand the current state of IBM, its critical to delve into its intricate history. The company has navigated through the rise of the personal computer, the internet revolution, and the cloud computing era, each time striving to maintain its relevance and market dominance. Recent developments, including strategic acquisitions and divestitures, signal a company undergoing a profound transformation. The key to its future hinges on its success in capturing the potential of hybrid cloud and AI. These areas represent not only significant growth opportunities but also the core of IBMs current strategic focus. But before we go further, let's analyze its basic profile.

| Feature | Details |

|---|---|

| Company Name | International Business Machines Corporation (IBM) |

| Ticker Symbol | IBM (NYSE) |

| Industry | Technology (Computer Hardware, Software, and Services) |

| Headquarters | Armonk, New York, USA |

| Core Business Areas | Hybrid Cloud, Artificial Intelligence (AI), Consulting, Software, Hardware |

| Global Presence | Operates in over 175 countries |

| Recent Strategic Focus | Hybrid Cloud and AI |

| Annual Dividend | $6.68 per share |

| Dividend Yield | 2.72% |

The latest available stock quotes and historical data are crucial for any investor considering IBM. Real-time quotes, along with comprehensive historical charts, provide the tools needed to track the stock's performance over time. Financial websites such as the Wall Street Journal (WSJ), Yahoo Finance, and NASDAQ offer up-to-the-minute information and historical data. Investors can view daily, weekly, or monthly price movements to gain perspective on the stock's trends. These resources also provide analyst ratings, which are critical for determining the consensus view on the stock. The convergence of all this data, including past performance and current market conditions, is critical for making informed decisions.

Analyst ratings provide valuable insights into the investment potential of IBM. The consensus rating, based on a compilation of analyst opinions, often offers a "buy," "sell," or "hold" recommendation. A "buy" rating suggests that analysts believe the stock's price will increase, while a "sell" rating indicates a predicted price decrease. A "hold" rating implies analysts expect the stock price to remain relatively stable. These ratings are typically accompanied by a rating score, such as A3, which represents an average of the analysts evaluations. The number of "buy," "hold," and "sell" ratings are crucial indicators of the market sentiment. For instance, a strong concentration of "buy" ratings can signal robust confidence in the company's future, although investors should always carry out their own research.

The financial news and headlines surrounding IBM can influence investment decisions. Announcements regarding quarterly earnings, new product launches, partnerships, or strategic initiatives can significantly impact the stock price. It's essential for investors to stay informed about these developments through reputable financial news sources. Reports on earnings per share (EPS), revenue figures, and any upgrades or downgrades from analysts are particularly critical. After-market earnings reports are of special note as they often cause swift, if temporary, stock reactions. News that affects the broader tech sector can also influence IBM. Keeping abreast of news related to the Federal Reserve's (Fed) interest rate decisions, for example, can influence market sentiment towards tech stocks in general and IBM in particular.

IBM's performance is closely tied to its various business segments, including software, hardware, and consulting services. The software segment, particularly areas like hybrid cloud and AI, is a significant growth driver. IBM's success in this domain helps counteract challenges in other areas and underlines the corporations adaptability. Hardware sales, particularly for mainframe computers, still contribute significantly to revenue. Consulting services complement both software and hardware, offering clients comprehensive IT solutions. The integration of these segments is key. The success of IBM in the hybrid cloud and AI spaces will largely determine its future trajectory. Furthermore, the revenue generated from these areas, combined with financial information, offers a deeper look into IBM's operations and prospects.

A significant shift in IBM's strategy involves its focus on hybrid cloud technology. This approach enables businesses to integrate their data and workloads across public and private clouds, thereby offering greater flexibility, scalability, and control. IBM has made considerable investments in cloud platforms, services, and acquisitions to strengthen its position in this crucial market segment. Key technologies like Red Hats OpenShift, which IBM acquired, have played a crucial role in this strategy, providing robust solutions for hybrid cloud environments. By focusing on cloud computing, IBM can provide essential products and services, aligning itself with the IT needs of enterprises. The hybrid cloud strategy is not only critical for revenue generation but is also expected to transform how businesses manage their IT infrastructure.

Artificial intelligence (AI) is another fundamental aspect of IBM's current strategy. The company has made substantial advancements in AI, with its AI capabilities being integrated into its software, hardware, and consulting services. IBM's AI solutions range from specialized tools to enterprise-grade platforms, giving businesses access to cutting-edge technologies. Significant investments have been made in AI research, development, and the training of AI models. With increased use of AI, IBM hopes to enhance its consulting services, assist in managing hybrid cloud environments, and expand its market. By providing AI solutions, IBM is aiming to lead the way in digital transformation.

A company's financial metrics provide important clues about its success and investment potential. Factors such as revenue, earnings, and earnings per share (EPS) are essential for evaluating the companys performance. Investors should scrutinize IBM's financial statements, including the balance sheet, income statement, and cash flow statement, to assess the company's overall financial health. In addition, examining the company's debt levels and cash reserves provides valuable insight into its ability to fund operations, undertake investments, and weather economic downturns. Comparisons with industry peers provide context, offering a better idea of its relative performance. Regularly monitoring these financial metrics will help investors to make informed decisions about IBM.

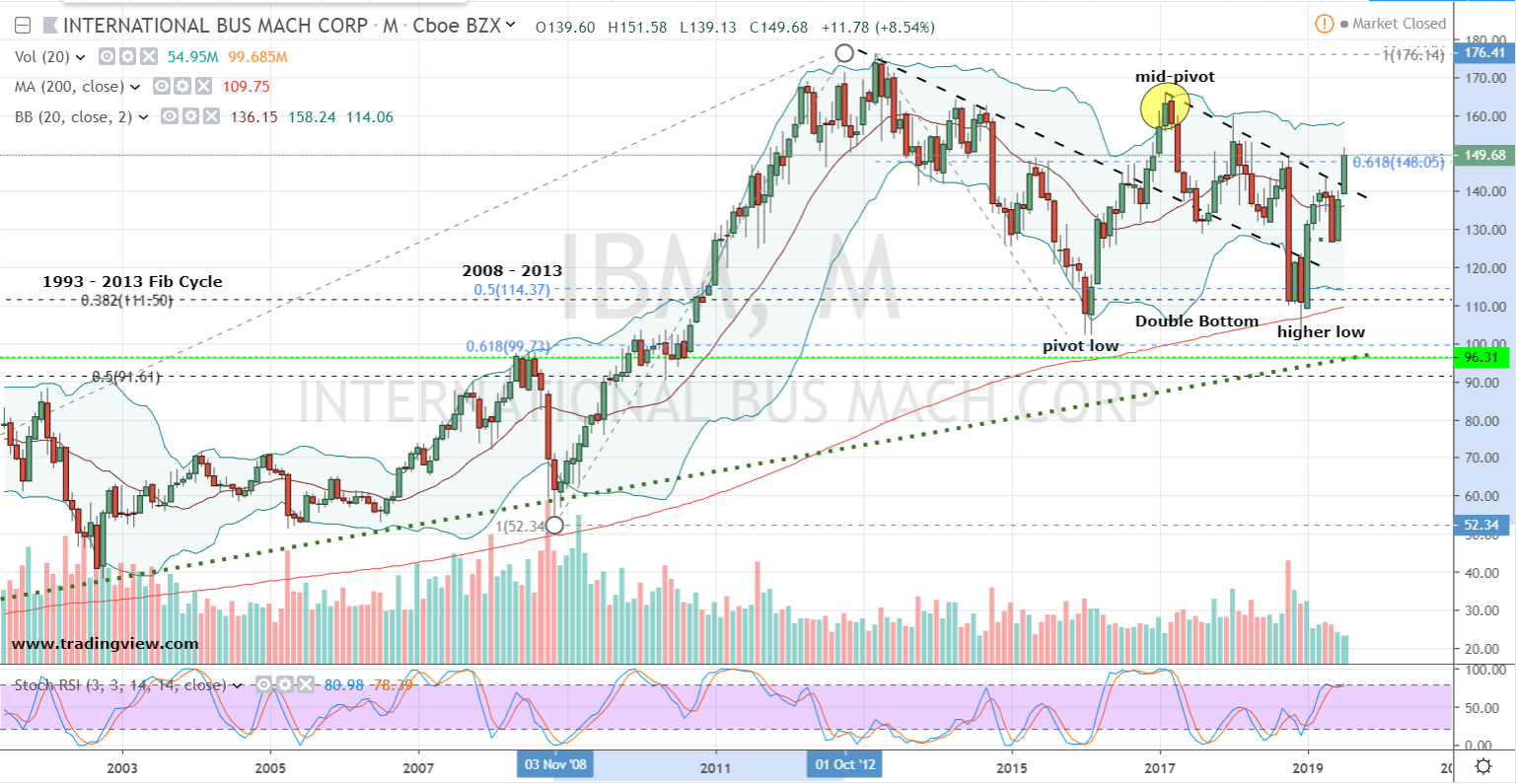

The stock performance of IBM has undergone fluctuations, and its price has been affected by various factors, including broader market conditions and company-specific events. Some periods may show consistent growth driven by positive earnings reports, successful product launches, or strategic partnerships. On the other hand, the stock may face challenges during times of economic uncertainty, industry-specific headwinds, or unfavorable news. Analyzing the company's stock history, including daily, weekly, and monthly price movements, offers valuable insights into its trends. Examining these historical charts and patterns helps investors in identifying support and resistance levels, assessing volatility, and making decisions. The stock performance provides insights into the company's trajectory.

In the competitive technology sector, IBM must navigate several hurdles. Shifts in consumer preferences, evolving technological advancements, and the presence of rival companies pose constant challenges. The rapid innovation cycle in areas such as cloud computing, AI, and data analytics needs IBM to continuously adapt and invest in research. Furthermore, the company faces increased competition from both established tech companies and emerging start-ups, making it essential to differentiate its offerings and maintain a competitive edge. Addressing these challenges effectively is crucial for IBMs long-term success. Staying informed about industry trends and adapting to market dynamics are critical.

Dividend payments, which offer investors a stream of income, can play an important role in an investment strategy. IBM has a track record of returning value to shareholders through regular dividend payments. Investors in IBM may get the benefit of consistent dividend income, which can supplement any stock appreciation. The yield is determined by the dividend amount and the current stock price, providing a measure of the return on investment. The financial stability and sustained profitability of the company support its ability to sustain dividend payments. These payments, in turn, may attract income-seeking investors. By analyzing IBM's dividend history and yield, investors can make informed decisions.

The community of traders and investors provides a forum for people to share their thoughts and gain valuable insights. Online forums, social media platforms, and investment communities provide chances for people to exchange ideas, discuss trading strategies, and learn from the experiences of others. Investors can study analyst estimates, track company news, and share views on the stock performance of IBM. The community offers a place for investors to assess market sentiment and obtain different perspectives. Participating in such communities can help investors broaden their knowledge, get new trading ideas, and stay up-to-date on market trends. Interactions can aid in creating investment strategies.

A detailed review of IBM's current landscape shows that the company is undergoing a dramatic transformation. A significant strategic shift to hybrid cloud and AI is the core of IBMs future. Although the company has experienced mixed results, analysts generally recommend the stock. Factors, including the strategic pivot, dividend payments, and the possible effects of recent Fed rate cuts, make IBM a potentially appealing investment. However, like all investments, IBM carries risks. By analyzing current information, investors can decide whether to "buy," "sell," or "hold" the stock. Investors should do their own research and assess their risk tolerance before making any financial decisions.

Looking ahead, IBM faces a complex landscape. It must effectively implement its hybrid cloud and AI strategies, compete in an ever-changing industry, and meet the needs of its shareholders. Its success in these endeavors will determine its long-term future, offering opportunities for investors who are prepared to watch and take part.